Managing your finances can seem daunting, but using a check register can help you stay organized and keep track of your expenses. It’s a simple tool that can make a big difference in your financial health.

A check register is a written or electronic record of all your transactions, including checks written, deposits made, and any other withdrawals or payments. It helps you see where your money is going and avoid overdrawing your account.

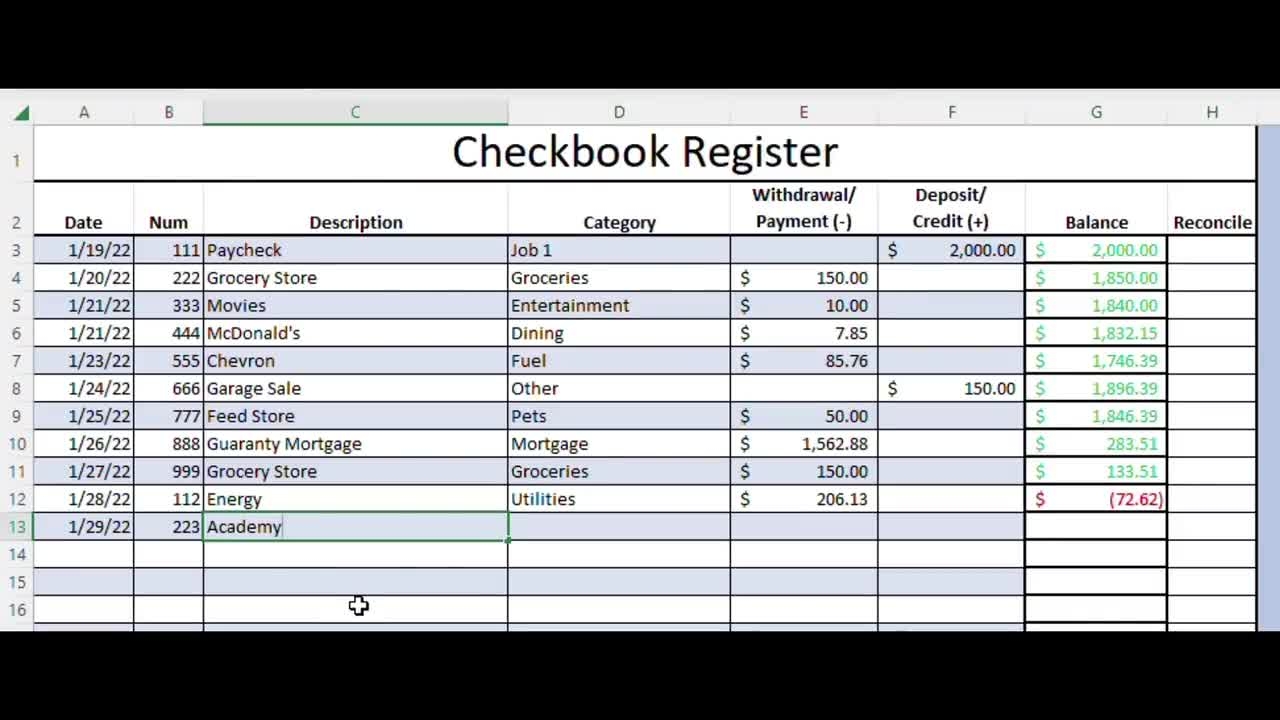

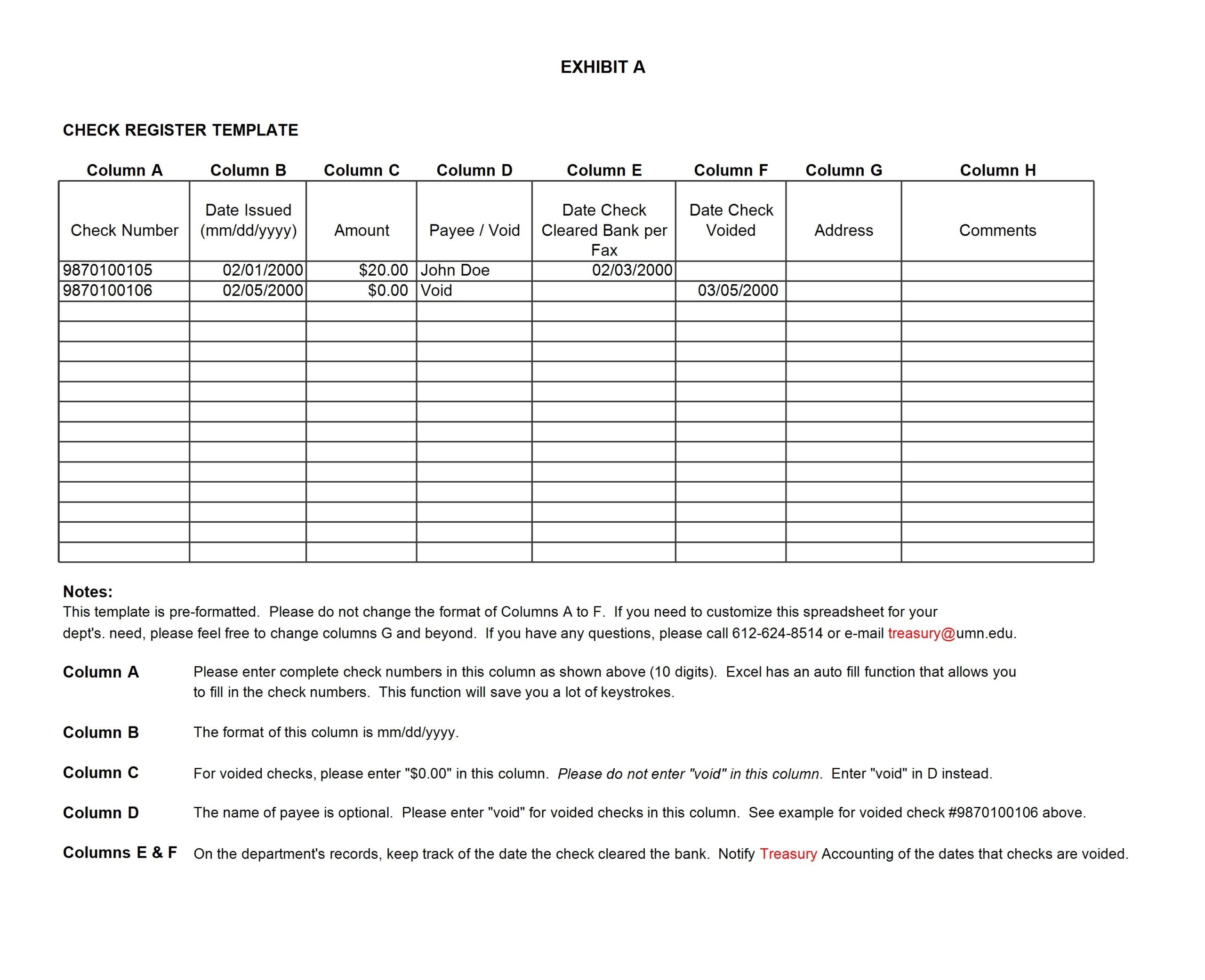

example of a check register

Example of a Check Register

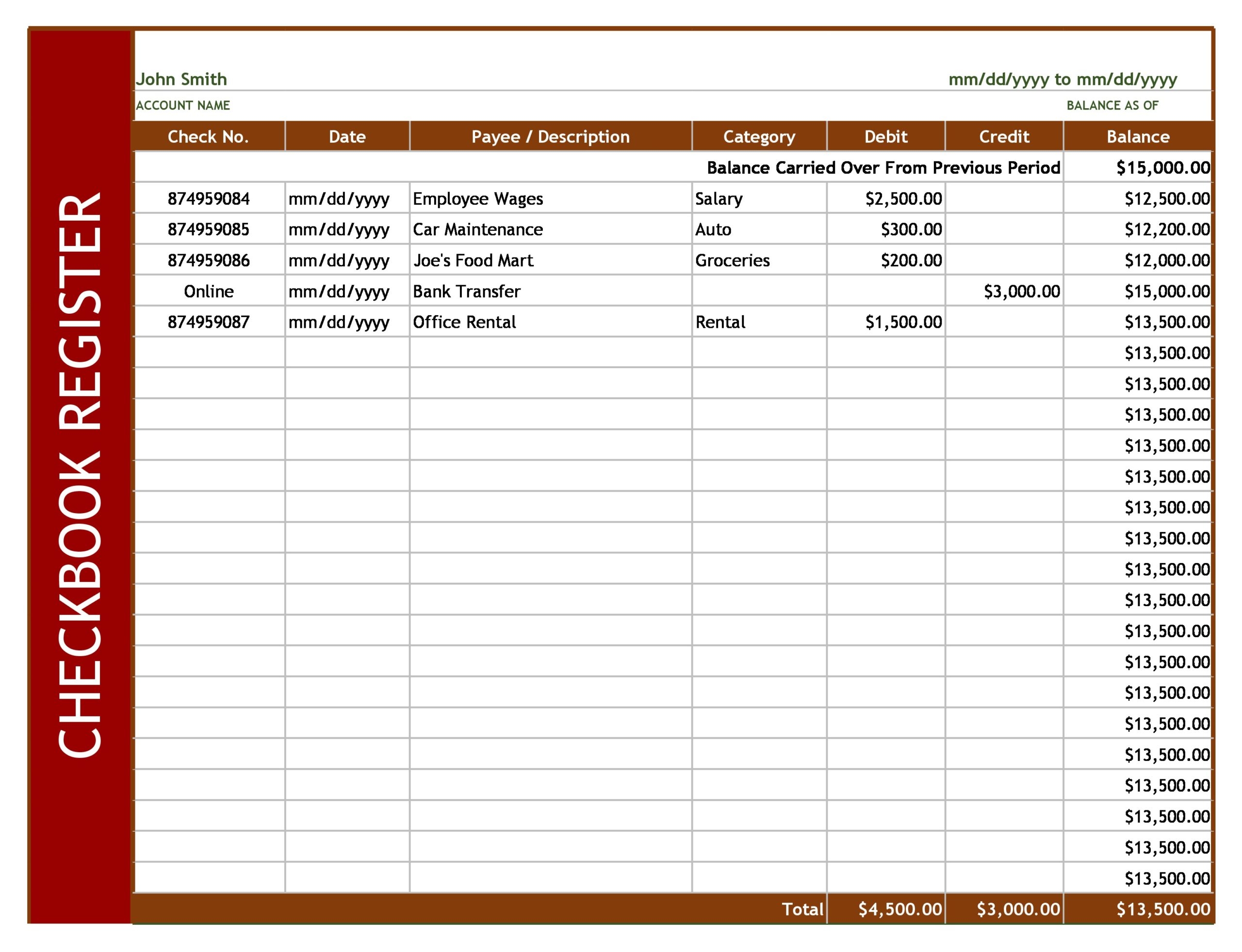

Let’s say you start with a balance of $500 in your account. You write a check for $50 to pay a bill. You record this transaction in your check register, subtracting $50 from your balance. Your new balance is $450.

The next day, you deposit $100 in cash. You add this deposit to your register, increasing your balance to $550. Then, you use your debit card to make a $30 purchase. You deduct this amount from your balance, leaving you with $520.

By keeping track of every transaction in your check register, you always know how much money you have available. It’s a simple yet effective way to manage your finances and avoid surprises when you check your account balance.

Remember, consistency is key when using a check register. Make sure to update it regularly and reconcile it with your bank statement to catch any discrepancies. With a little effort, you can take control of your finances and make smarter money decisions.

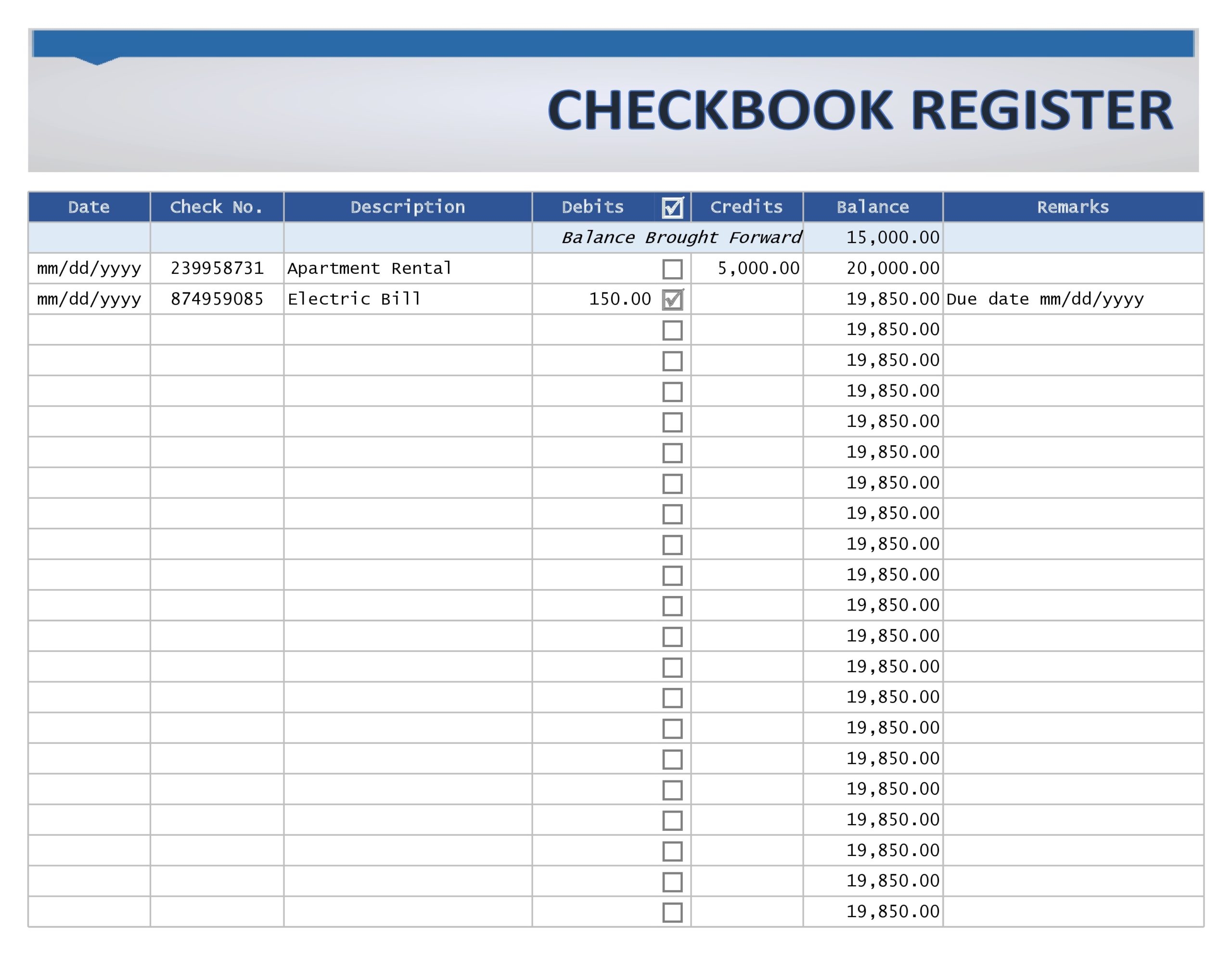

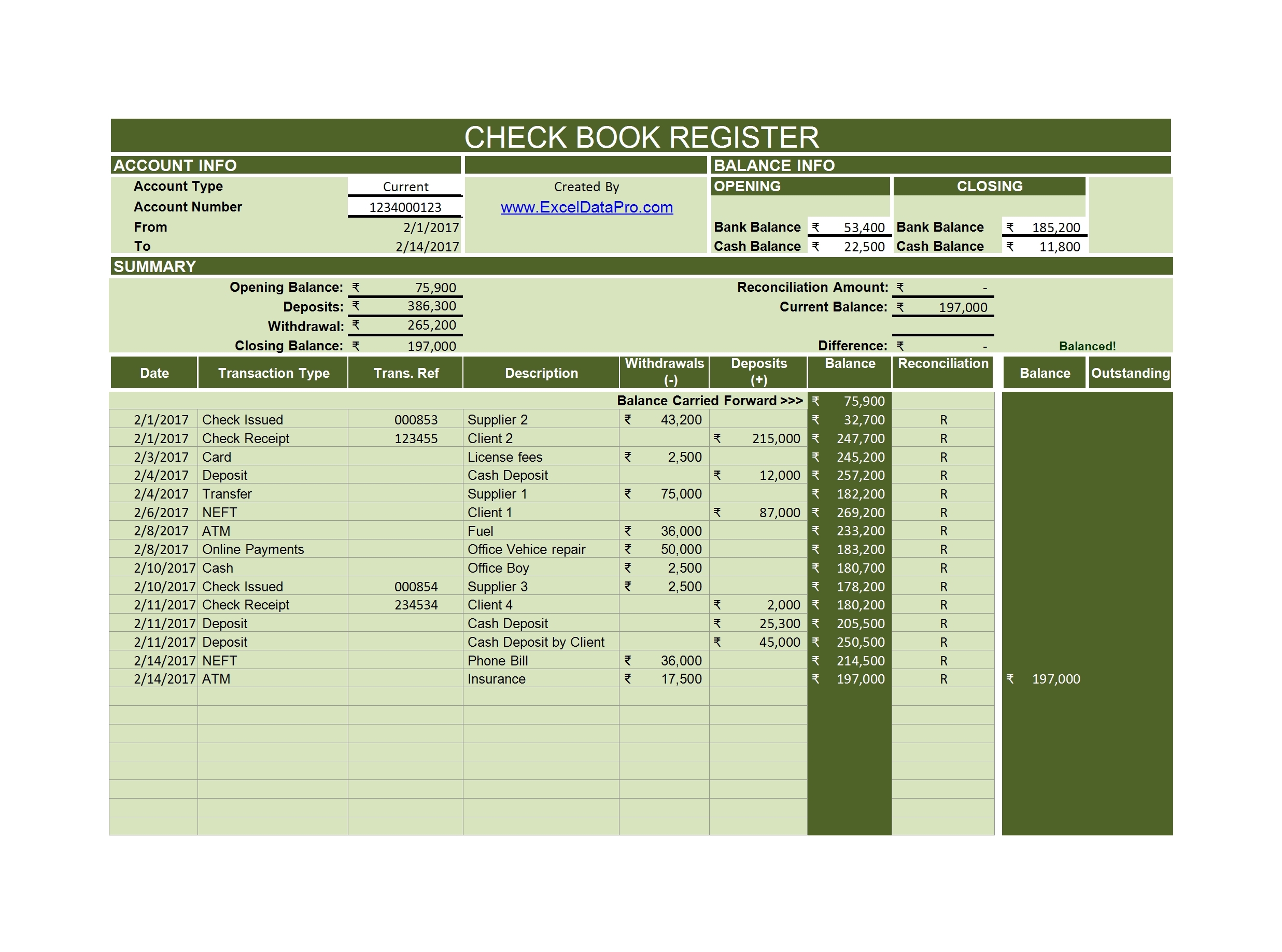

7 Check Register Examples To Download

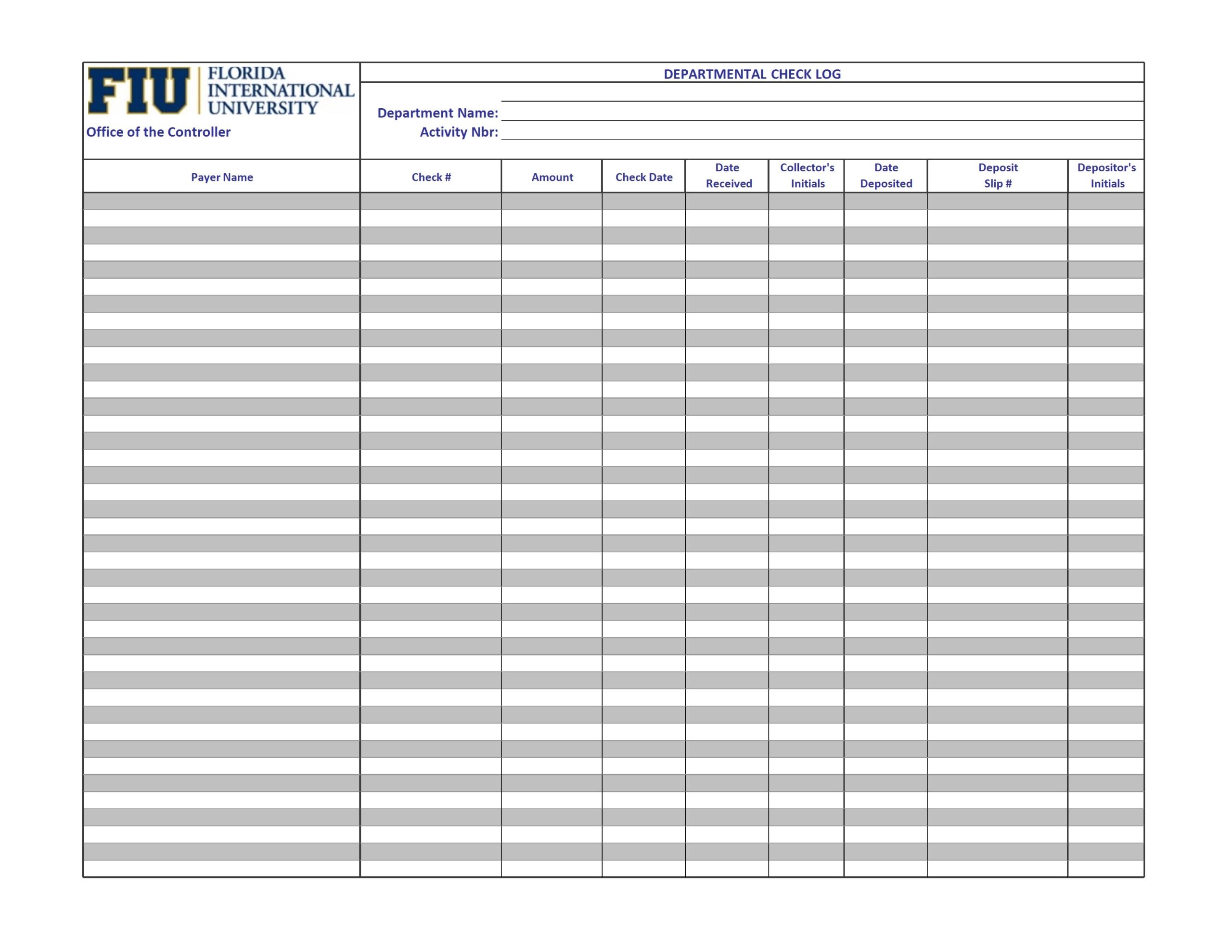

39 Checkbook Register Templates 100 Free Printable TemplateLab

7 Check Register Examples To Download

7 Check Register Examples To Download

39 Checkbook Register Templates 100 Free Printable TemplateLab